Filing Your Taxes Online

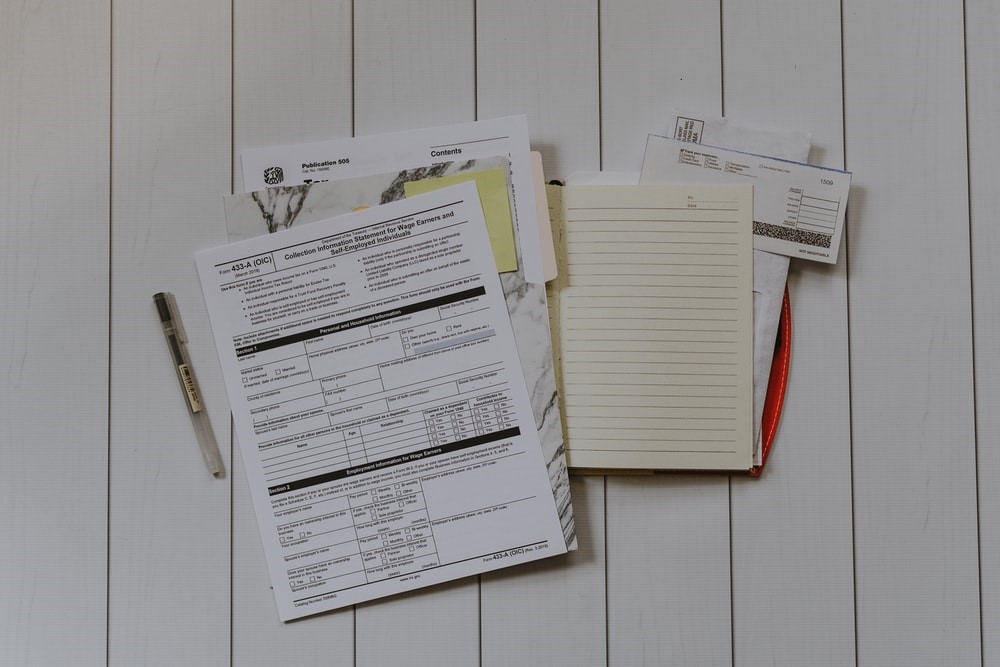

Tax season is upon us. Taxes have been able to be filed, but the IRS did not start processing taxes until February 12th.

Filing taxes can seem like a daunting task, but with the help of online tax filing services it has never been easier. Everything you will need came be found on the IRS website if you know where to look. The IRS has created a private partnership with many industry leaders that allow users to use their brand-name products for free, but only if you go through the proper channels. Turbotax for example is in partnership with the IRS in their Free Filing program if you use the links provided by the IRS. If you simply go to Turbotax website there will be a fee included. There may still be a preparation fee for state taxes as the Free File program only applies to federal taxes.

Where do I file my taxes?

To begin you will need to access the “Free File” section of the IRS which can be found here. Free File is currently open and available. Upon arrival there are two options, Income for $72,000 and below and Income above $72,000.

If you belong to the below $72,000 category you will be taken to a page that will explain what documents, you need to complete your filing, these include income statements such as W2s or 1099s.

When you are ready to file, you are able to browse all of options included in the Free Filing program. These options are provided by industry leaders such as turbotax, TaxSlayer and many more. Each program varies slightly by target audience so you will want to make sure you are picking the service that best fits you. When you find the service that best fits you, you will be redirected to their website, but since you went through the Free File program from the IRS website your filing is free.

If you belong to the above $72,000 category you will have to select “Free File Fillable Forms”. This avenue of filing is different than using the services provided for the sub $72,000 category. The fillable forms are electronic federal tax forms that can be filed for free online. These forms will allow you enter your tax information online, electronically sign and file your return and print your return for personal records. The major difference of the two is that free fillable forms does not give guidance, so you should be comfortable doing your taxes on your own.

Your taxes are not filed until you receive an email verifying that the IRS has received your submission.

When will I get my return?

You can track where your tax return is in and an estimated date that you will receive your tax refund by using “Where’s My Refund” tool provided by the IRS, or their mobile app IRS2Go. Most refunds will be issued within three weeks of filing. If you use the free file program or another form of online filing, you can begin checking the status of your refund within 24 hours. If you mail your tax return you will have to wait at least four weeks to check the status.

Taxes are due on April 15th, but that date may change like it did last year to give people more time to file during the pandemic.

prednisone 40 mg tablet: https://prednisone1st.store/# prednisone coupon

ourtime inloggen: dating sites free near me – beste dating site

best medication for ed: best medication for ed – ed pills comparison

online canadian pharmacy certified canadian pharmacy

Long-Term Effects.

best ed treatment pills: ed treatments – ed drugs compared

All trends of medicament.

buy generic propecia prices buy cheap propecia pill

https://mobic.store/# order cheap mobic

amoxicillin 500 mg: https://amoxicillins.com/# amoxicillin medicine

get generic propecia pills cost propecia prices

http://cheapestedpills.com/# otc ed pills

drug information and news for professionals and consumers.

cost of propecia without rx buying propecia for sale

Get warning information here.

canadian pharmacy ratings canadian pharmacy service

best ed medications the best ed pill top rated ed pills

https://pharmacyreview.best/# canadian pharmacy 365

home buying propecia price

buy amoxicillin 500mg capsules uk over the counter amoxicillin – buy amoxicillin 500mg

ed remedies: cheapest ed pills – ed drugs list

cheap canadian pharmacy prescription drugs canada buy online

amoxicillin online no prescription buy amoxicillin online uk – amoxicillin generic

https://propecia1st.science/# cheap propecia without dr prescription

Get here.

mens erection pills: men’s ed pills – compare ed drugs

Some trends of drugs.

canada drugs online canadian discount pharmacy

amoxicillin buy canada medicine amoxicillin 500mg – generic amoxicillin over the counter

canadian pharmacy meds: best canadian pharmacy online – maple leaf pharmacy in canada

http://indiamedicine.world/# top 10 pharmacies in india

п»їbest mexican online pharmacies: mexican online pharmacies prescription drugs – reputable mexican pharmacies online

https://indiamedicine.world/# india online pharmacy

canada drugs reviews: legitimate canadian pharmacy online – my canadian pharmacy

https://certifiedcanadapharm.store/# canadian pharmacy checker

indian pharmacy paypal: indian pharmacy – buy prescription drugs from india

legitimate canadian pharmacies: the canadian pharmacy – canadian pharmacy india

http://certifiedcanadapharm.store/# canada pharmacy online

http://mexpharmacy.sbs/# mexican rx online

canadian drugstore online: canada online pharmacy – canadianpharmacymeds com

buying prescription drugs in mexico online: purple pharmacy mexico price list – medication from mexico pharmacy

http://certifiedcanadapharm.store/# online canadian pharmacy reviews

buy medicines online in india: indian pharmacies safe – п»їlegitimate online pharmacies india

pharmacies in mexico that ship to usa: medication from mexico pharmacy – best online pharmacies in mexico

http://certifiedcanadapharm.store/# canadian pharmacy reviews

http://certifiedcanadapharm.store/# canadianpharmacy com

indian pharmacy online: reputable indian pharmacies – reputable indian pharmacies

pharmacies in mexico that ship to usa: reputable mexican pharmacies online – buying from online mexican pharmacy

https://certifiedcanadapharm.store/# canada pharmacy world

https://indiamedicine.world/# mail order pharmacy india

mexican border pharmacies shipping to usa: medicine in mexico pharmacies – mexican rx online

canadian valley pharmacy: canada rx pharmacy – pharmacy rx world canada

http://indiamedicine.world/# world pharmacy india

https://gabapentin.pro/# canada where to buy neurontin

https://azithromycin.men/# cost of generic zithromax

ivermectin generic: ivermectin 4000 mcg – cost of ivermectin lotion

neurontin 200 mg neurontin singapore neurontin tablets 300 mg

http://stromectolonline.pro/# ivermectin generic name

ivermectin pill cost: stromectol ivermectin 3 mg – cost of ivermectin 1% cream

http://azithromycin.men/# average cost of generic zithromax

zithromax canadian pharmacy where to get zithromax zithromax 250 mg tablet price

zithromax 500mg price: order zithromax over the counter – zithromax 500 mg for sale

https://azithromycin.men/# where can i buy zithromax uk

https://azithromycin.men/# zithromax buy online no prescription

https://ed-pills.men/# new ed pills

best erection pills: medication for ed – non prescription ed pills

https://ed-pills.men/# over the counter erectile dysfunction pills

cheapest antibiotics: buy antibiotics from canada – Over the counter antibiotics for infection

https://lisinopril.pro/# cost of brand name lisinopril

http://lisinopril.pro/# lisinopril 20 mg brand name

http://lisinopril.pro/# lisinopril 20 mg online

https://ciprofloxacin.ink/# cipro

http://ciprofloxacin.ink/# ciprofloxacin generic price

http://misoprostol.guru/# order cytotec online

https://misoprostol.guru/# buy cytotec online

https://avodart.pro/# how can i get cheap avodart no prescription

http://lisinopril.pro/# lisinopril 5 mg over the counter

http://misoprostol.guru/# cytotec pills buy online

https://mexicanpharmacy.guru/# п»їbest mexican online pharmacies

legit canadian pharmacy ordering drugs from canada canadian pharmacy drugs online

online pharmacy india: india pharmacy – best online pharmacy india

http://indiapharmacy.cheap/# best online pharmacy india

india online pharmacy: reputable indian pharmacies – indian pharmacy paypal

indian pharmacies safe: international pharmacy india – indian pharmacy paypal

best india pharmacy: indian pharmacies safe – buy medicines online in india